$200 trillion is the estimated worth of existing financial contracts referencing the LIBOR as the rate in calculations. But the LIBOR is going away at the end of 2021.

What about new financial contracts? LIBOR is still being referenced, so borrowers and traders need to check the language to make sure they incorporate the appropriate fallback language suggested by the Alternative Reference Rates Committee (ARRC).

What is the alternative benchmark rate going to be? The SOFR, Secured Overnight Financing Rate. ARRC was formed in 2018 to provide insight into limiting the risks related to LIBOR, coordinate and plan the process of transitioning to alternative reference rates and confront the risk issue of legacy contract language.

Who’s on the ARRC? Here are a few of the members:

Bank of America, the Federal Reserve Board, Fannie Mae, Freddie Mac, HSBC, Morgan Stanley, JP Morgan Chase, PIMCO, Goldman Sachs, Wells Fargo, World Bank, Intercontinental Exchange, BlackRock, New York Fed, FDIC, FHFA, CFPB, Commodity Futures & Trading Commission, SEC, Treasury, and others.

- ARRC adopted a Paced Transition Plan with timelines for transition to the SOFR. The type of products referencing LIBOR include:

Derivatives

Business Loans

Mortgages and other consumer loans

Floating Rate Notes

Securitized products

There are 10 work groups detailing and addressing the issues in specific areas. Here are a few:

Consumer Products Working Group – Chair is David Beck from JP Morgan Chase. This group is creating contract language for consumer loans referencing the LIBOR and also working on ideas of what to do with legacy contracts.

Legal Working Group – Chaired by Maria Douvas-Orme from Morgan Stanley and Emilio Jimenez from JP Morgan Chase. This group is tasked with finding and addressing the legal issues surrounding the the LIBOR/SOFR transition.

Securitization Working Group – Chaired by Sairah Burki from the Structured Finance Industry Group and Lisa Pendergast from CRE Finance Council. This group is creating contract language for residential and commercial mortgage backed securities, asset backed securities and collateralized loan obligations. They are also working on issues surrounding legacy contracts.

Borrowers with existing loans benchmarked to the LIBOR should check with their lender or loan servicer for information specific to them. New borrowers should be looking for the appropriate fallback language if LIBOR is the reference rate.

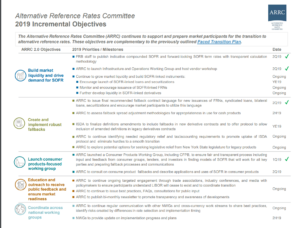

Today (June 6, 2019) ARRC released their 2019 Incremental Objectives.