With the June Supreme Court ruling stating that CDC cannot establish or extend its rental eviction moratoria, the Biden-Harris Administration requested federal agencies that insure or guarantee single family housing loans extend their foreclosure related eviction moratoria to Sept. 30, 2021.

If your client owns a home that has a HUD/FHA loan, a USDA loan, a VA loan or a FHFA (Fannie/Freddie) loan, then they are affected by the Administration’s request.

HUD announced the eviction moratoria on foreclosed borrowers and other occupants of homes with federally backed mortgages is extended to Sept. 30, 2021.

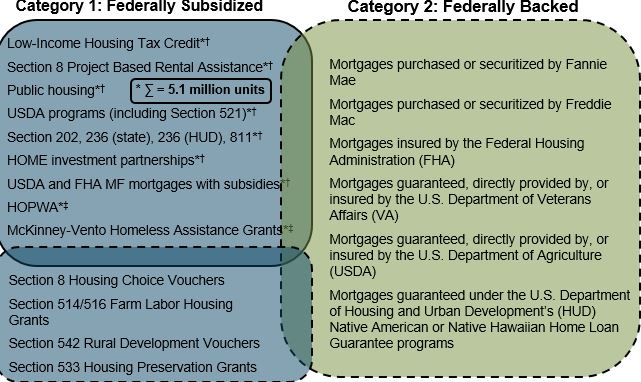

As part of the Federal Reserve’s analysis (June 2020) of affected properties under the CARES Act, you can find information on CARES Act covered rental units.

To help tenants find out if they are living in a multi-family building with a Fannie Mae or Freddie Mac loan on it, both agencies have a financing look up tool. This will allow tenants in multi-family buildings to find tenant protections placed on distressed property owners who have been foreclosed on or are in the process of being foreclosed on.

On Thursday, July 29th, Rep. Waters introduced a bill to extend the general rental eviction moratoria begun by the CDC, but lacked the votes to get the bill to the House floor.

NAR weighed in on the bill and restated its ongoing position that rather than further hurt rental property owners, the vast majority of which are individuals, by extending the time period that they have no income with which to pay property related bills, taxes and maintenance; Congress, Treasury and the Administration should increase efforts to distribute to rental property owners the already provided $ 50 billion in emergency rental assistance.

You can read more about the Biden-Harris Administration’s statement, NAR’s statement and other information at the July 30, 2021 blogpost.