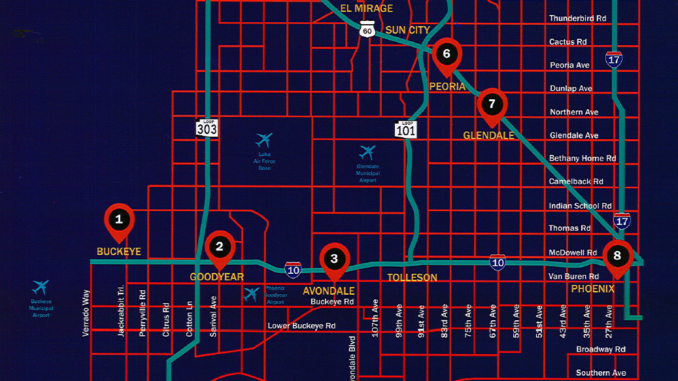

June 2018 Opportunity Zones were finally identified. WeMAR GAD posted a piece with links to information, census tracks and the map. Now Treasury has issued guidance so investment can begin.

It is estimated that $8 Trillion has been sitting on the sidelines, waiting for this promised opportunity to come to fruition. There are a few issues still awaiting Treasury’s clarification, but by and large the private sector now has enough information to move forward with what they do best, create and build.

Opportunity Zones are designed to spur economic development and job creation in economically distressed communities. They were created by the tax reform bill known as the Tax Cuts and Jobs Act, December 2017. You can read more from the IRS on the Opportunity Zones Q&A page.

Basically, Opportunity Zones offer investors a mechanism to defer Capital Gains tax and, in some cases, pay no tax on the investment appreciation.

This can be a great tool for investors who cannot, or do not wish, to use a 1031 exchange.

Here is a quick outline:

- Investor divests of investment (real estate, stocks, mutual funds, other investment)

- Investor invests the Capital Gains into a Qualified Opportunity Fund within 180 days of asset sale/exchange

- Investments held for 5 years the taxable amount of the capital gains reinvested is reduced by 10%

- Investments held for 7 years, the taxable amount of the capital gains reinvested is reduced by 15%

- Investments held for 10 years, the taxable amount of the capital gains reinvested is reduced by 15% and no tax is owed on the appreciation

Like any other tax deferral tool, it is important to choose carefully so that the investment has the best chance to succeed and realize a gain.

One quick note: be mindful of your real estate license. Just as in TIC, REITS, or other investment vehicles, it can be easy to step over the line and end up touting the fund instead of acting as a real estate licensee. Make sure you are within your license and work with your broker to be assured you are not acting as an investment adviser.

To view Opportunity Zones in West Maricopa County, Pinal and Cochise, as well as the rest of Arizona, view the interactive map.

Clearly this is an opportunity for investors who do not wish to conduct a 1031 exchange or who are divesting of assets other than real estate. It is also an opportunity for communities. Investors, pooling funds and working with the community, to bring job and housing opportunities is a good thing. The incentives are not dramatic enough to encourage poor ideas or design.

There is an Entrepreneurship component to Opportunity Zones, designed to encourage business, but the Treasury Department is still working on clarification to those rules.

There are some excluded businesses such as golf courses, country clubs, massage parlors, hot tub facility, suntan facility, race tracks and other business types.

Investment in Opportunity Zones includes purchasing vacant land and building a qualified facility, but it also includes rehabilitation of an existing facility. In order for the rehabbed property to qualify, there must be “substantial improvement” of the property. The property will be considered “substantially improved” if additions to the property double the basis within 30 months of acquisition by the QO Fund.

December 31, 2019 is an important date in order to receive the basis increase for holding a property 5 years. The rules stipulate that all gain will be recognized at sale or by Dec. 31, 2026. There are some nuances to an investor’s basis, so investors should consult their CPA.

Overall, these zones target areas needing and wanting private investment, after all the zones were chosen locally. Keep in mind an investor can layer Opportunity Zones with other types of investment incentives. For example, in some areas the Opportunity Zone also resides inside a Foreign Free Trade Zone. Now think of investment types, like the all rental subdivision. Building an all rental subdivision in an Opportunity Zone may be a perfect opportunity to provided needed detached housing, with a maintenance free lifestyle in an area gathering new employers and jobs. These truly are Opportunity Zones.

Resources you may find helpful:

U.S. Treasury Opportunity Zones Resources

IRS Rules Oct. 2018

IRS Q&A

ACA – Arizona Commerce Authority

Snell & Wilmer Opportunity Zone Presentation

Opportunity Zone Map of Arizona

Grant Thornton: Opportunity Zone Guidance