If you are resident of Glendale and a registered voter, you will be asked to approve an $187 Million Bond Issue at the November 3rd election.

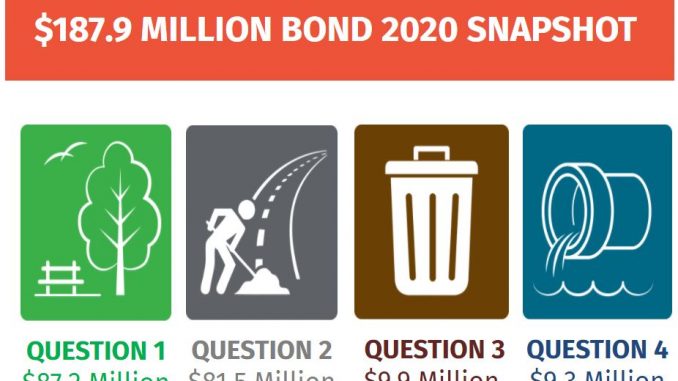

That bond issue will show up on your ballot as a series of four questions:

- Do you wish to approve an $87.2 Million bond for parks?

- Do you wish to approve an $81.5 Million bond for street construction?

- Do you wish to approve an $9.9 Million bond for landfill expansion?

- Do you wish to approve an $9.3 Million bond for drainage projects?

So, what is a Bond? It is the issuance of debt.

The City put together a short video explaining what a bond is and a series of videos describing the projects contained in this bond issue. You can also watch a video of the Public Information Meeting held a few weeks ago.

The next public meeting will be October 12 from 10am to 12 noon at the Glendale Main Library.

Looking for a list of projects? The City of Glendale has a 16-page pdf you can download. But that is the fun part, imagining all the improvements. What is more difficult is imagining the affect these bond issues will have on individual property owners, tenants and the City affordability overall for business and residential properties.

So back to the original question, What is a Bond? It is debt issued by the City to finance large projects. The bonds can be issued at various times, in various amounts, at various interest rates, for a specific number of years. They may be as short as 7 years or as long as 25 years, or any other term needed.

Investors (entities or individuals) purchase the bonds as an investment with an expected return on investment (the interest rate).

The next question is, How are the Bonds Paid Back? In this case, the Landfill Bonds are expected to be paid back from landfill user fees. The remainder of the bonds will be paid back through the secondary property tax (on all property types). Property owners rightly want to know what the impact on their property taxes will be over time. For tenants, they may be impacted as landlords may increase rents to compensate for the additional tax burden.

There are several questions a voter should be asking themselves and the City. Questions regarding property taxes if the municipal bond market becomes more expensive than it currently is and other questions like:

- What happens if the muni bond fund market dramatically slows down?

- How does the City plan to control the price of issuing the bonds?

- How is the City impacted financially by the addition of this debt?

- How does the City plan to pay back the bonds?

- Will the benefits of the bonds substantially outweigh the risk of the debt burden?

And so many more questions

WeSERV had these and additional concerns, so we sent a letter to the Glendale City Manager, Kevin Phelps. Mr. Phelps responded with a detailed letter outlining the City’s approach.

You may wish to read the WeSERV letter and the City of Glendale’s response as part of your decision-making process.

If you are a property owner, pull down your detailed property tax bill to review and try to determine the impact of this tax on your property taxes and how this debt will affect your property affordability given the other taxes and overrides on your property tax bill.

In the end, you will need to do the math for you and your property. If your budget becomes tight, will you be able to keep up on your property taxes? Or will the amount of outstanding debt through bond issues and overrides become a burden that causes you to default on your property taxes?

In 2017 I wrote a blog post regarding the City of Surprise Bond Issue and provided a sample property tax analysis for the average priced home at the time. You may find it helpful to refer to that post.

Here are other sources of information:

- EMMA – Electronic Municipal Market Access

- Fidelity

- MuniNet Guide

- GOVCB – Government Contracts & Bids

- Steps to Issuing a Municipal Bond – slides

- MunicipalBonds.com

- Investopedia Think Twice Before Buying Tax-Free Muni Bonds

- Barron’s You’re Cornered if You’re a City

- Wall Street Journal Muni Defaults Surge, but Yields Don’t Follow

- Roosevelt Institute – Municipal Banking: An Overview

- Louis D. Brandeis School of Law – Other People’s Money

- Wall St Journal – Lawmakers Tangle Over Fed’s Muni-Market Rescue

- Wall St Journal – When Buying Muni Bonds, Investors Should Look Beyond Their Own States

- Wall St Journal – Risk Creeps Into Municipal Bond Market, Yet Prices Stay High

- CNBC – The Fed says it is expanding its municipal bond buying program

- Testimony of Margaret Levenstein to Senate Committee on the Judiciary – Cartel Prosecution: Stopping Price Fixers and Protecting Consumers

- Investopedia.com – Bond Yield vs. Coupon Rate: What’s the Difference?